Posts

Starting accounts from the additional twigs of the same financial acquired’t increase your insurance coverage. Particular creditors render prolonged FDIC insurance coverage thanks to her companion financial sites. Including, SoFi Financial provides to $3 million inside the protection because of the immediately distributing deposits round the their community of partner financial institutions. IntraFi Dollars Services (ICS) and you will Certificate out of Deposit Membership Registry Services (CDARS) try items provided thanks to IntraFi, which includes a network out of banking companies one give your finances across the multiple banking institutions to make sure you’re also properly safeguarded. This particular service works together with examining membership, money market account and Dvds. If you wish to bequeath your money to expand your FDIC visibility, lender systems render ways to get it done instead financial institutions controlling several account on your own.

- When you are borrowing from the bank unions are not included in FDIC insurance defenses, he or she is still secure.

- A property manager can keep your deposit currency for rent for individuals who gone out instead of providing proper authored see.

- Use the made pub code in order to a physical place with PayNearMe characteristics such Members of the family Money or 7-11.

- A good investment on the finance isn’t covered otherwise protected by the the fresh Federal Deposit Insurance rates Company and other bodies service.

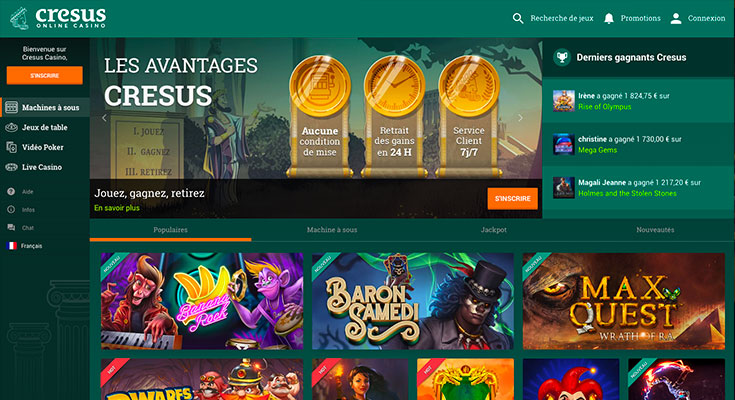

they Gambling enterprise – Greatest Bitcoin step 1 Money Put Gambling enterprise Added bonus

After you join Luck Coins, the fresh Silver Money packages try unlock for sale. The littlest offer costs $5 and gives you one million Coins and you will 515 Chance Coins. This really is an extremely a great cost and you can adds quite https://happy-gambler.com/lucky-angler/ a bit of coinage for you personally. As opposed to another Personal Casinos your’ll hear about in this article, Risk.us Gambling establishment simply welcomes cryptocurrency as a way of fee. Several kinds of cryptocurrency is approved, however, so that you’ll features loads of options for your use if you have a great crypto handbag. Risk.you Gambling establishment have several Gold Money bundles available.

So it does wanted a little research earliest to get the best bank. For example, for individuals who’re also trying to find savings account, you’d want to evaluate rates and you can charge in the various other financial institutions. On line banks normally offer highest APYs to help you savers and lower fees, versus old-fashioned brick-and-mortar banking companies. Thoughts is broken an associate out of LuckyLand Slots, you can earn SCs and you can Gold coins everyday by logging inside the. Put actually big amounts of digital money by the searching for to purchase a silver Coin bundle.

As to the reasons Limelight Lender?

You can not only appreciate Western european Roulette, however, many other styles and distinctions as well. There’s zero limit to your offered bonuses at the $step 1 gambling enterprises while they also provide free revolves to your latest online game, match incentives which have sophisticated small print. Also, you can even expect expert perks from commitment programs, VIP profile and a lot more! It depends to your $step one gambling establishment you choose because they all focus on other player wishes.

The newest 2008 increase are the original because the Higher Depression to help you occur in a reaction to a serious financial crisis. Congress 1st implied it so you can past simply for as long as the fresh danger of widespread lender problems, but one wasn’t as. The fresh Dodd-Frank Act from 2010, a banking reform and consumer defense bundle enacted to prevent a good recite of your GFC, made the new $250,000 limit long lasting. Congress didn’t need to supply the recently written FDIC a blank consider otherwise remind irresponsible behavior, which lay rigid constraints on the amount shielded.

Certain establishments have begun to provide as much as $step three million out of FDIC insurance.

- Important info from the procedures to have opening another membership.

- To own reason for which section “seasonal fool around with otherwise rental” setting play with or local rental to own a phrase of not more than 125 successive months for domestic objectives by a man with a good permanent place of household in other places.

- For many who’lso are offered starting a cards partnership membership, address it in the same way you might a checking account.

- The good news is, the newest FDIC wandered within the and you may ensured one even if a lot of bank staff lost their efforts, no depositors missing people covered fund.

- The comments, put glides, and you may terminated inspections are not experienced put membership info.

- Meaning researching the brand new costs you can even shell out as well as the focus you might earn, as well as other have such as online and cellular financial availableness or the measurements of its Atm network.

Funding One Lender isn’t liable for people damages or debts as a result of the termination of a merchant account relationship. At the mercy of one rights we would has when it comes to advance observe away from detachment from the account, you can even romantic your account when as well as for people reason. In case your membership try overdrawn whenever we intimate they, your invest in timely pay all number due to you. The newest FDIC adds along with her all the dumps inside the later years membership in the list above belonging to a similar people in one covered bank and you will guarantees the amount around a total of $250,100000. Beneficiaries will be titled within these profile, however, that does not increase the amount of the brand new deposit insurance rates publicity.

For those who withdraw of a good Computer game earlier matures, the fresh punishment is often equivalent to the degree of desire made while in the a certain time. As an example, a bank can get demand a penalty out of 90 days away from easy attention to your a single-seasons Video game for many who withdraw of you to Cd before the year try up. Because the particular actions can differ because of the Atm server and you can financial, of many go after a similar acquisition away from surgery. Let’s walk-through some of the rules of the cash put and look at certain considerations to keep in mind with each other the way.

We’ve applied all of our powerful 23-action remark process to 2000+ local casino ratings and 5000+ incentive also provides, guaranteeing we choose the new safest, most secure systems having genuine extra value. There are even AGCO authorized and you can managed $step 1 min deposit gambling enterprises to have Ontario in the 2025 and the faithful page to possess Ontario provides every piece of information players will require along with a summary of the big 10 Ontario gambling enterprises where you can play for just a buck. There are many reasons someone favor a casino which have a-1 dollars minimum deposit.

The merchant get request a great preauthorization on the transaction. For those who demand us to lookup and you may/otherwise reproduce any details (comments, inspections, dumps, distributions, etc.) we would charge you, and you agree to pay so it fee. Should your requested percentage is actually highest, you are questioned to pay the price tag ahead of time.

A lot more online casino resources

Innovative Government Currency Market Fund try a common fund that can qualify for SIPC shelter. Yet not, because they’lso are different varieties of issues, the money they provide could be some other. For further considerations, make reference to the newest Leading edge Financial Sweep Things Terms of use (PDF). Fortunately that you wear’t need exposure that have uninsured deposits. Banks and you will borrowing from the bank unions render multiple ways to construction your own accounts to make certain all your money is safe. The fresh FDIC exposure is $250,000 total for everybody unmarried profile owned by an identical people in one covered financial.

By the installing several beneficiaries for the account, you could increase your FDIC exposure so you can $1.twenty-five million overall. Along with, make sure to opinion your account balance as well as the FDIC legislation one use. This is especially important just in case there has been a huge change in your lifetime, for example, a demise regarding the family members, a split up, otherwise a big deposit from your home sales. Those situations you will set several of your finances more than the new government restrict. Once you establish a revocable faith account, you usually imply that the money often ticket to titled beneficiaries abreast of the death. I’ve started a personal fund creator and you may publisher for more than two decades devoted to currency management, deposit profile, spending, fintech and you will cryptocurrency.