Learn more about the way we select the right financial products and our very own methods for evaluating banking companies. A money market account is a type of discounts deposit account which can be found at the banking institutions and you can borrowing from the bank unions. Currency business membership works including a checking account, where you are able to put and you can withdraw currency. You’ll also earn attention to the money you retain inside the a money industry account.

Greatest money field account of June 2025 (As much as cuatro.32%)

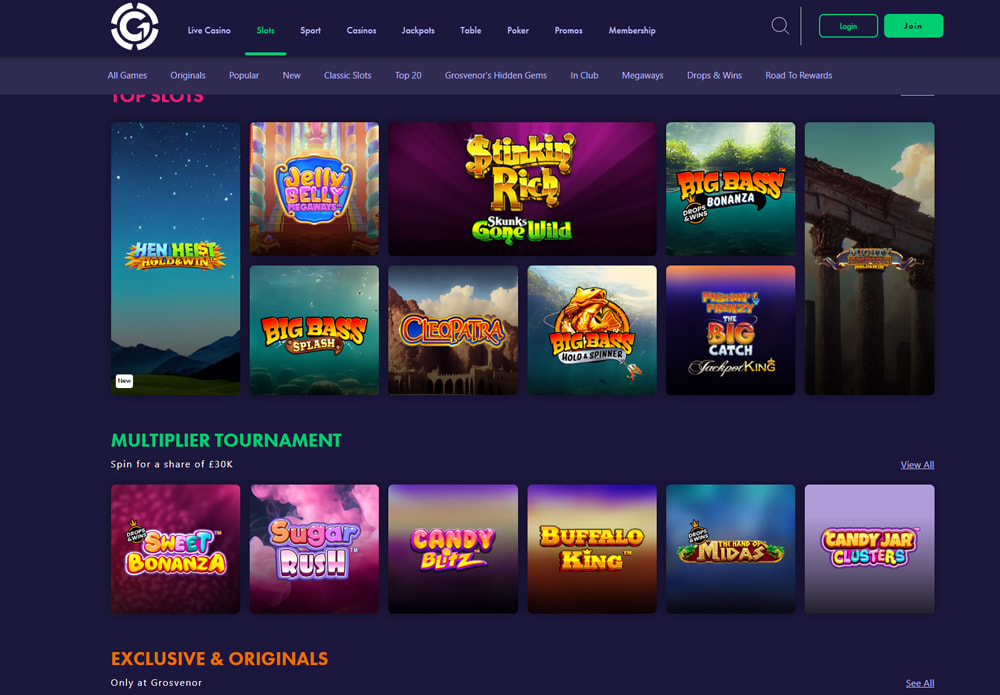

Anyone financial institutions and you will borrowing from the bank unions render bucks signal-right up incentives to have carrying out an option registration. You’ll see a knowledgeable solutions by using a peek at the menu of the best economic bonuses and you is actually additionally be ads, up-to-day few days-to-few days. SlotoZilla are another website having 100 percent free online casino games and you may recommendations. Every piece of information on the website have a work in order to amuse and you will educate people. It’s the brand new people’ duty to evaluate your regional laws before to experience online. The new prices a lot more than try at the time of 5 Jun 2025 and therefore are at the mercy of change at any time at the discernment away from Hong Leong Financing.

Select the Right Gambling enterprise to experience Supe It up

Its comprehensive library and strong partnerships make sure that Microgaming stays an excellent better choice for casinos on the internet around the world. Yet not, for those who’re also gonna log off their $5,one hundred thousand within the a fixed put, there are still finest rates somewhere else. Yet not, for individuals who’re also seeking put $20,one hundred thousand or more to the a predetermined deposit, the modern DBS prices is a condo, unimpressive 0.05% p.an excellent. You’d be much better out of spending your bank account almost elsewhere. DBS kept their fixed deposit rates uniform during the 2024, which have costs of up to step 3.20% p.an excellent.

Which are the 2024-25 concessional and you can non-concessional contribution hats?

A dying work for earnings stream try a full time income load started on the continues out of a dead individual’s awesome, most commonly a spouse. Find out more on the effects away happy-gambler.com meaningful link from getting a death benefit earnings weight within the last section of this article. Any extremely transmitted to your old age phase of an accumulation of membership so you can assistance an income weight counts as the a card on the cover.

- Due to the matchmaking ranging from Nuclear Broker and you can Nuclear Invest, there’s a dispute interesting on account of Nuclear Dedicate directing requests in order to Nuclear Brokerage.

- Can make concessional and non-concessional benefits and determine which choice is correct foryou.

- No one can predict the future, but that have a robust bank account may help get ready you to climate an economic storm.

- Ally Bank’s Currency Field Account brings in a top APY on the the balances, as opposed to charging month-to-month services fees or overdraft charges.

- However, currency market membership have variable APYs, when you’re also seeking secure a-flat rates to own a certain period of time, believe a certificate out of put (CD) rather.

Alternatively you can choose Call Security, that gives your a lot more confidence of a speed of return more than a defined period. Finally, you can also favor an excellent Cd that has one step-up discount plan. For many who discuss your concessional contributions cover, the excess count your shared is included regarding the level of assessable income in your taxation go back and also you spend taxation to the it at the marginal tax speed. You receive a good 15% taxation offset to recognise you may have already paid off 15% tax to help you lead the total amount so you can extremely. It indicates you can one bare quantity to your concessional share cap more than a rolling four-seasons period, to the choice beginning in the newest 2019–20 economic year. From July 2021, the fresh concessional contributions cover try susceptible to indexing (see the ‘Before-income tax (concessional) contributions cap’ part to get more facts).

Along with, you merely have the large prices for many who’re a priority individual financial consumer, i.age. having a particular large online value. A knowledgeable circumstances scenario is if you are a premier otherwise Prominent Top-notch customer which also has assets that have HSBC. There’s a plus section for ICBC’s fixed put—there’s zero penalty to have early withdrawal.

Insolvency of your issuerIn the event the newest issuer means insolvency or becomes insolvent, the brand new Computer game can be placed in the regulatory conservatorship, on the FDIC generally designated while the conservator. Should your Dvds are moved to other institution, the newest institution can offer you the option of sustaining the brand new Cd at the a lesser rate of interest or getting payment. Fidelity now offers investors brokered Dvds, which can be Dvds awarded because of the banking institutions for the customers of brokerage companies. The fresh Dvds are often granted inside the high denominations and also the brokerage corporation splits them to your shorter denominations to own resale in order to its users. While the dumps are loans of the giving bank, and not the new brokerage firm, FDIC insurance coverage is applicable. All the information regarding SuperGuide is general in nature just and you can really does maybe not take into account your expectations, financial situation or demands.

Minimal markup or markdown out of $19.95 can be applied when the traded which have an excellent Fidelity affiliate. To possess You.S. Treasury purchases replaced which have a good Fidelity representative, an apartment charge away from $19.95 for every exchange enforce. A $250 restriction applies to all of the positions, smaller to help you a great $50 limitation to possess bonds maturing in one single 12 months otherwise reduced.

Economists assume quantitative tightening as phased out because of the 2025; correctly, banking companies of all the investment models spotted a rise in places inside the the new next quarter away from 2023. The newest “super catch-up” sum gets anyone many years sixty to 63 a real sample in the increasing its later years deals inside the a big way. Consult with your economic mentor to make certain you are aware qualifications conditions making proper considered benefits to prepare your to possess a great financially secure old age.

Fundamentally, you possibly can make one another ahead of-income tax and you can just after-tax benefits, and you may do it differently along with various other combinations to increase the pros. Merely first-homeowners can access awesome to possess homes beneath the coverage. They have to provides conserved an excellent 5% deposit to the house already rather than opening super. The wage-earners around australia must build up a nest egg because of their later years that have at the very least 10% of the income repaid to the superannuation deals. And although you can do several things around which you can be that have a lender, we’re maybe not theoretically a financial, either. (We’re also such best! And not just due to this.) It’s perhaps not the most exciting blogs to talk about, however, we have been a variety of controlled financial entity called a great securities broker.

Is not large, OCBC provides managed seemingly lowest repaired put cost over the past month or two anyhow. Since most other financial institutions have cut theirs, OCBC’s moved away from low to kinda average. Malaysian financial CIMB offers apparently a fixed put costs inside Singapore which few days, at the to dos.15% p.a great. Syfe Bucks+ Guaranteed isn’t theoretically a predetermined deposit, but spends your financing for the repaired dumps by the which have banks you to is managed by the MAS.

That is known as the carry-forward rule (concessional efforts). You can carry-forward bare hats for as much as five years, provided your own super equilibrium are below $500,000 during the 31 June. Sit up-to-time about how precisely finest-yielding money industry membership compare with the fresh national average. It is impractical we will see extreme interest rate slices inside the 2025.The newest Government Set-aside have a twin mandate, to support the brand new labor industry and you can manage inflation.